The Best Guide To Credit Card Terminals For 2025 In The USA

Welcome to the ultimate guide for the best payment terminals of 2025 in the USA! As a business owner, retailer, or service provider, you must learn how credit card terminals operate and select the appropriate one to impact your sales, customer satisfaction, and security significantly. The world of credit card processing equipment is constantly evolving, and staying ahead requires understanding the options, costs, and features of all the latest credit card machines available today. Let's learn everything you need to know about the best payment terminals for 2025, so you can be well-informed and continue being at the top of the game.

Overview Of Card Machines And Credit Card Terminals

The central unit of payment processing comprises different types of card payment terminals, such as credit card terminals, POS terminals, and contactless payment terminals. These units are programmed to support other payment methods, from magnetic stripe cards to contactless NFC payments.

Types Of Payment Terminals In 2025:

Types of payment terminals in 2025 are more diverse than ever. The best credit card terminals for your business depend on your needs, whether mobility, speed, or security.

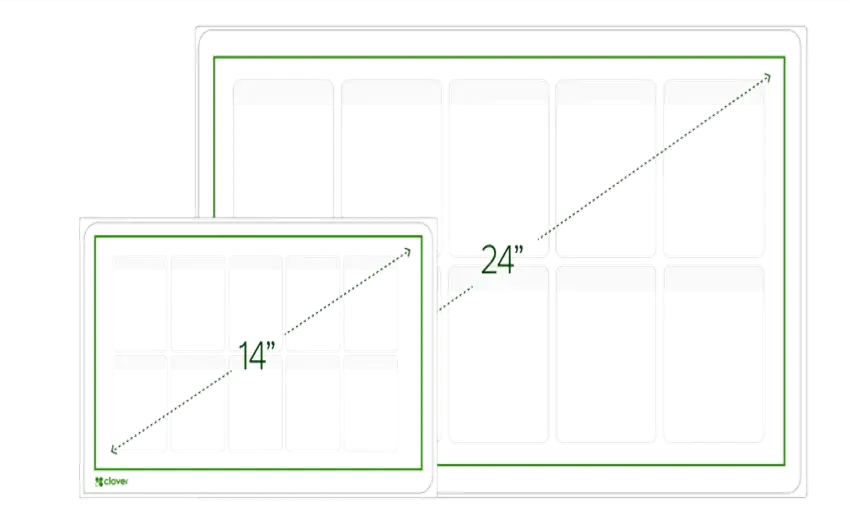

Countertop Payment Terminals: These are the most popular credit card terminals employed in retail outlets. They feature products such as the Verifone payment terminal and the Ingenico POS machine, which provide strong security and reliability.

Wireless (Mobile) Credit Card Terminals: These mobile card machines or mobile credit card terminals allow merchants to accept card payments on the move. Products such as the Square credit machine and Ingenico move 5000 are ideal for mobile transactions.

Contactless Payment Terminals: Contactless credit card machines and contactless credit card terminals that support NFC technology speed up the transaction and ensure security.

Outdoor Payment Terminals: Used for petrol stations and outdoor use, these terminals are designed to be rugged and usually come with EMV chip readers.

Virtual Terminals: For remote or e-commerce payments, virtual terminal payments enable merchants to receive card payments through software.

Popular Payment Terminal Devices

Terminals like the Verifone e285, Ingenico Lane 7000, and PAX A77 are some of the top payment terminals for 2025. These terminals use EMV chip technology, contactless payments, and wireless connectivity, which makes them suitable for various business settings.

What Are the Advantages Of The Top Credit Card Terminals?

Security: They meet PCI DSS standards.

Speed: Reduced transaction time translates to shorter wait times for customers.

Versatility: Accommodate multiple payment types—magstripe, chip, contactless.

Integration: Seamlessly integrate with POS systems and payment processing equipment.

In a nutshell:

In 2025, the top payment terminals for business in the USA are those that offer security, speed, mobility, and affordability. Whether you need a portable card payment machine, a countertop unit, or a contactless payment terminal, there's a solution for you.

How Do Payment Terminals Function In 2025?

Payment terminals in 2025 are advanced hardware machines that capture card payments rapidly and securely. They are interfaced with payment processing hardware through wired or wireless connections, facilitating seamless payment for merchants and consumers alike.

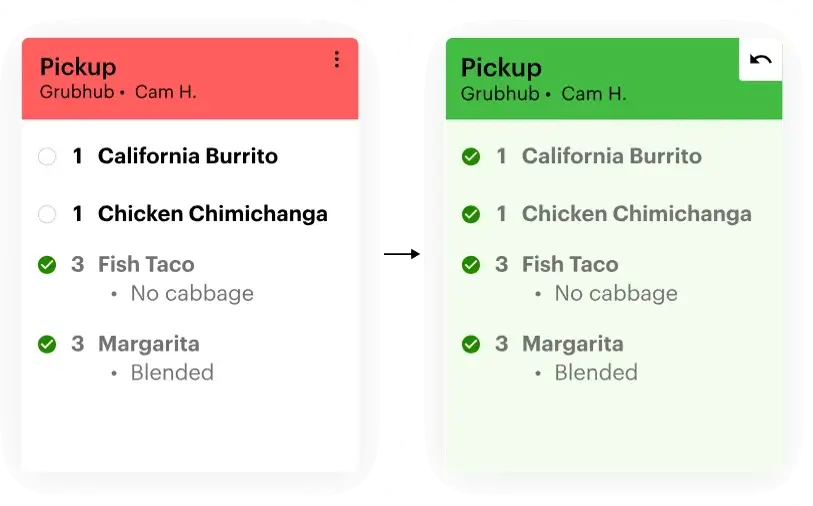

Card Payment Processing Process

Card Swipe, Insert, or Tap: Consumers display their credit cards, debit cards, or smartphones with NFC.

Data Transmission: The credit card payment terminal encrypts and processes the card data for security.

Authorization Request: The credit card terminal transmits the transaction information to the payment processing equipment through POS systems, Wi-Fi, Bluetooth, or cellular networks.

Bank Verification: The payment processing device communicates with the bank or card issuer for verification of funds or credit.

Transaction Approval or Decline: The terminal gets the response and shows the status of the transaction.

Receipt and Completion: After approval, the payment terminal finishes the transaction, and a receipt is printed or electronically sent.

Role Of Credit Card Processing Equipment

Credit card processing hardware, such as pin pads, credit card machines, and credit card devices, enables secure data transfer and promotes PCI compliance. Devices such as the Ingenico card reader and Verifone terminals also come equipped with built-in EMV chip readers, PIN pads, and contactless NFC capabilities to upgrade security and convenience.

Advantages Of Modern Payment Terminals

· Contactless Payments: Customers can pay through smartphones or contactless credit cards using NFC or QR codes.

· Wireless Connectivity: Mobile card machines and portable card machines allow for transactions anywhere.

· Enhanced Security: Tokenization and EMV chip technology minimize fraud.

· Integration with POS Systems: New card payment machines integrate seamlessly with installed hardware and software.

In the End:

In 2025, payment terminal functionality includes rapid, secure, and contactless processing, based on the most up-to-date credit card processing hardware and software. Advances in payment terminal technology enable businesses throughout the USA to accept multiple payment methods with greater efficiency and security.

What Are The Features And Benefits Of The Best Payment Terminals In 2025?

Selecting the best credit card terminals in 2025 requires evaluating attributes like cost, security, compatibility, and user-friendliness.

Benefits Of The Top Payment Terminals

· Greater Security: Terminals such as the Verifone e285, Ingenico Lane 7000, and PAX A77 provide EMV chip and contactless NFC payments, being PCI DSS compliant.

· Faster Processing: Newer terminals process payments quickly, reducing customer wait times.

· Flexibility: Magnetic stripe, chip, contact, and mobile payment support.

· Mobility: Wireless and portable card payment terminals enable you to make card payments anywhere.

· Cost-Effectiveness: Low transaction charges, competitive terminal rates, and rental possibilities make them affordable for small businesses as well as big companies.

Features To Consider In 2025

· Wireless and Wi-Fi Capabilities: For outdoor and mobile credit card terminals.

· EMV Chip Readers: To process secure chip cards.

· NFC and Contactless Support: For go-tap payments.

· Compatibility with Payment Processing Equipment: Simplifies the integration.

· User-Friendly Interface: Credit card keypad and easy-to-use software.

· Durability: Rough-and-tumble devices such as outdoor payment terminals for petrol stations or retail outlets.

Why The Right Payment Terminal Is Important

Having the top payment terminals of 2025 can decrease transaction times, minimize fraud threats, and enhance customer experience, thereby increasing sales. It's essential to choose a device that suits your business size, industry, and volume of transactions.

The top credit card terminals for 2025 combine security, speed, and versatility while being cost-effective. Devices such as wireless credit card machines, contactless terminals, and portable card payment machines are becoming standard across the USA, supporting diverse business needs.

How To Choose The Right Payment Terminal In The USA?

Selecting the right payment terminal for your business involves evaluating your specific requirements, budget, and future growth plans.

Key Factors to Consider

Type of Business: Retail, hospitality, petrol stations, or online merchants.

Payment Methods Supported: Contactless, EMV chip, magnetic stripe, NFC, mobile payments.

Connectivity: Wireless (Wi-Fi, cellular) or wired (Ethernet, USB).

Cost: Terminal purchase, rental, or lease options; transaction fees.

Security: Compliance with PCI DSS, encryption, and tokenization.

Compatibility: With current POS equipment and payment processing hardware.

Portability: If you require a portable card terminal or countertop terminal.

Brand and Provider: Established brands such as Verifone, Ingenico, First Data, and Thrifty Payments.

Top Brands And Devices To Look At

· Ingenico POS Machines: Reliable and secure.

· Verifone Credit Card Terminals: Most popular due to their EMV and contactless capabilities.

· Square Card Reader and Terminals: Best for small business owners and new startups.

· PAX A77 and Verifone e285: Advanced devices with enhanced features.

· Mobile Credit Card Terminals: For payments on the go.

How To Get A Credit Card Terminal For Your Business

· Purchase: Direct from manufacturers or approved resellers such as Thrifty Payments.

· Rental or Lease: Flexible terms are provided by many vendors.

· Integration: Check compatibility with your current payment processing hardware.

· Support & Maintenance: Select vendors with good customer support.

Selecting the appropriate payment terminal in 2025 depends on determining your business requirements, considering factors such as contactless payment machine support, security, and price. Market leaders, including Ingenico and Verifone, still reign supreme with their trustworthy, secure, and innovative credit card devices for businesses in the USA.

Payment Terminal Prices & Payment Terminal Cost In 2025

Knowing what it costs to get and keep payment terminals is essential for budget planning. In 2025, the prices for credit card terminals and related hardware depend on functions, manufacturer, and the service provider.

What Are The Typical Costs Of Payment Terminals In 2025?

· Purchase of Terminal: Between $300 $1,200 for sophisticated devices such as Verifone e285 or Ingenico Lane 7000.

· Rental Charges: Monthly rentals range from $30 to $60, usually with maintenance.

· Transaction Charges: Typically 1.5% to 3% per transaction, with the option of flat fees from some providers.

· Additional Equipment: PIN pads, contactless NFC readers, or mobile card readers incur extra charges.

Influencing Factors On Payment Terminal Prices

· Capability of Devices: Wireless, EMV chip, NFC, or multi-application capable terminals are more expensive.

· Brand and Model: Established brands such as Ingenico and Verifone are more expensive but provide stronger security.

· Volume and Contract Terms: Large businesses or high-volume transaction operators can negotiate lower rates.

· Additional Features: Customer display screens, contactless payment functionality, and integration features increase expenses.

Are There Cost-Effective Options?

· Buy vs. Rent: Small companies might find it cheaper to rent, but big players save money from buying outright.

· Free Terminals: Some payment processing companies provide free credit card terminals with a merchant account.

· Low-Cost Devices: Simple credit card swipe devices or credit card machines that are operated manually are low-cost but less flexible.

In 2025, the top payment terminals for your business weigh cost, functionality, and security. While choosing a low-cost EFTPOS machine or shelling out for next-generation EMV-compliant devices, knowing the overall costs—terminal cost, processing fees, maintenance—is the key to optimizing ROI.

FAQs: Everything You Need to Know About Credit Card Terminals

What Is the Best Payment Terminal?

The best payment terminal of 2025 is based on your business requirements. For retail businesses, countertop credit card terminals such as the Verifone e285 or Ingenico Lane 7000 are the best choices because they are secure and fast. For mobile vendors, wireless credit card machines or portable card payment machines such as the Square credit machine or the Ingenico move 5000 are best. The top credit card terminals accommodate contactless payments, EMV chip technology, and seamlessly integrate with your current credit card processing hardware.

How Do Payment Terminals Operate?

Payment terminals operate by securely communicating card information from the customer's card to payment processing hardware through wired or wireless connections. Equipment such as the credit card swipe machine, pin pad, or credit card units encrypt information and talk to banks or card issuers to facilitate the authorization of transactions. New credit card terminals, including wireless terminals and contactless credit card machines, process transactions fast using EMV chip readers and NFC technology, allowing quick and secure transactions. Credit card processing hardware plays a crucial role in ensuring PCI compliance and protecting customer information.

What Is the Ideal Way to Accept Payments?

The ideal way is business type-dependent. For payments in-store, it is best to use a credit card machine such as the Ingenico, Thrifty Payments, or Verifone POS terminal with EMV chip and contactless capability. For remote payments, virtual payment terminals or online payment gateways are proper. Contactless payment terminals and mobile credit card terminals offer quick, secure, and easy options for merchants and customers alike. Having more than one payment method—magnetic stripe, chip, NFC, and mobile payments—guarantees the highest flexibility and customer satisfaction.

What Is the Best Way to Take Card Payments?

The ideal way to accept card payments is a secure and dependable credit card payment terminal that accommodates multiple payment types. Wireless credit card readers and portable card readers facilitate flexibility, most particularly in crowded surroundings or outdoor locations. Keeping in mind that your device must be contactless payment-enabled, EMV chip-processed, and have an easy-to-use credit card keypad will make the process as smooth as possible. Having the card payment terminal integrated with your POS device or payment processing hardware maximizes workflow and minimizes errors.

What Is the Cheapest Card Payment Machine?

The most affordable card payment device is usually a manual credit card device or a simple credit card swipe device, which can be bought for less than $300. Such equipment is ideal for low-volume businesses or as standby equipment. The devices, though, usually do not have contactless or EMV capabilities, which are critical for security and compliance. For cheap models with additional features, leasing or renting a credit card terminal might be more financially advisable, particularly for small enterprises.

What is the safest way to pay with a card?

The most secure method of paying with a card is to use an EMV chip-enabled contactless credit card terminal with NFC capability. Contactless payment terminals and contactless credit card terminals minimize physical contact and the risk of skimming a card. Another step is to use a PIN pad and make sure that your credit card hardware supports encryption and tokenization. Keep your credit card hardware up to date and PCI DSS-compliant at all times.

Is There a Free Way to Accept Credit Card Payments?

Certain payment terminal businesses and processors provide complimentary credit card terminals with the establishment of a merchant account or enrollment in their programs. Although the unit might be free, fees on transactions and monthly service fees usually apply. It is critical to evaluate overall expense, including processing fees, to ascertain whether a complimentary credit card terminal represents the least expensive option for your business.

What is the Smartest Way to Pay Off a Credit Card?

The most innovative way to pay off a credit card involves making more than the minimum payment each month and prioritizing high-interest debt first. Automating payments through your bank or using a credit card payment device can help avoid late fees and reduce interest costs. Avoiding cash advances and maintaining low balances relative to your credit limit also improves your credit score and financial health.

Can I Accept Card Payments on My Phone?

Yes, with mobile credit card terminals or card payment machines in a portable form, you can accept payments by card from your smartphone or tablet. Machines such as Square terminal credit card machines or Ingenico mobile credit card terminals connect via Bluetooth or Wi-Fi, making them ideal for selling on the move, selling outdoors, or in pop-up shops.

How Do I Time Credit Card Payments?

Timing credit card payments involves making payments before the due date to prevent late fees and interest charges. Paying through a payment terminal with scheduling capabilities integrated into it or automated payments can effectively manage timings. In case of online and virtual payments, having your payment processing hardware properly configured avoids delays.

What Is the 15 3 Rule for Credit Cards?

The 15/3 rule advises paying at least 15% of your credit card balance within three days to avoid interest charges and improve your credit score. Utilizing a credit card terminal to process payments promptly helps adhere to this rule, especially for business owners managing multiple cards.

What Is the Best Day to Pay a Credit Card Bill?

The best day to pay a credit card bill is before the due date, ideally a few days in advance. This ensures your payment clears on time, avoiding late fees and interest. Using the online virtual terminal for payments or automated payment features simplifies this process.

How to correctly pay a Credit Card?

To make a credit card payment properly, utilize a secure credit card terminal or online payment portal. Verify the transaction is approved, and have receipts or confirmation emails available. Refrain from disclosing PINs or card information via unsecured means, and consistently monitor your statements for unauthorized charges.

Conclusion

The sea of credit card terminals for 2025 in the USA may appear daunting, but with proper information, you can choose the most suitable payment terminals for your company. From comprehending the classification of credit card machines to assessing cost and features, this guide offers a balanced overview to ensure you make the right choices. Whether you require a mobile card payment machine, contactless payment terminal, or durable countertop device, the options are numerous and technologically advanced.

Investing in top-class credit card terminals not only improves your payment processing ability but also increases security, customer satisfaction, and operational efficiency. Don't forget to analyze your business's unique requirements, go through the costs incurred, and select well-known brands such as Ingenico, Verifone, or Square.

Beat the competition in 2025 by embracing the latest credit card processing technology customized for your business and customer needs. For any additional questions or recommendations on selecting or purchasing the best payment terminals, contact reliable providers or payment terminal firms to identify solutions specific to your company's needs.