How To Choose The Right Retail Merchant Account For Your Store In The USA

Opening or expanding a retail business in the USA is accompanied by an abundance of choices—location, stock, image, and, most importantly, merchant accounts. But what precisely is a retail merchant account, and how do you choose the best retail merchant account in the USA for your particular business requirements? Whether you're an independent boutique or a big-box store, knowing and selecting a retail merchant account for your business is essential for secure, smooth, and efficient transactions.

Here, we'll cover it all—what is a retail merchant account? A profound guide for the USA retail business owners: why do you need one, how to compare providers, and what to avoid. And we'll answer frequently asked questions to ensure you make a decision that works for your store today and in the future.

What Is A Retail Merchant Account And Why Is It Essential For Your Store?

A retail merchant account in the United States is a specialized bank account that allows your store to accept credit and debit card payments. If you’re wondering, “What is a retail account?” it’s essentially the financial gateway that facilitates retail merchant payment transactions, both in-store and online.

Why is it so important? Consumers today like to pay using credit cards or electronic wallets. Without a compelling retail merchant account for the US, your store restricts payment choices, risking sales. The top retail merchant account options provide quick and secure transactions in the USA, safeguarding customer information and facilitating convenient cash flow.

How Retail Merchant Accounts Function And What Are Their Main Advantages?

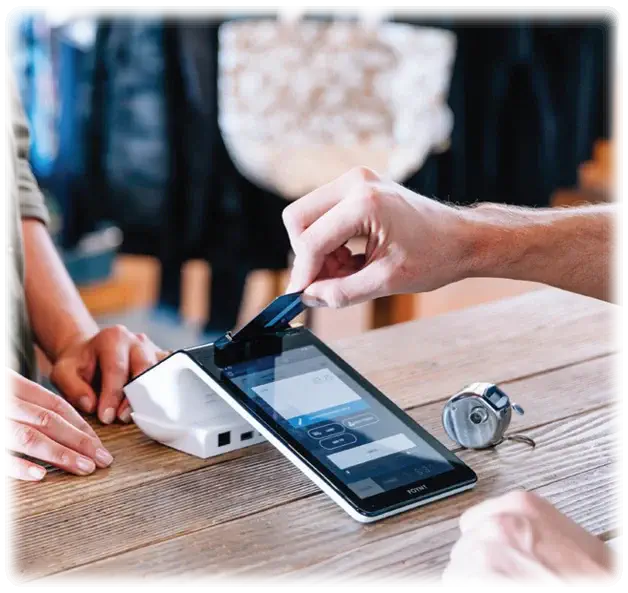

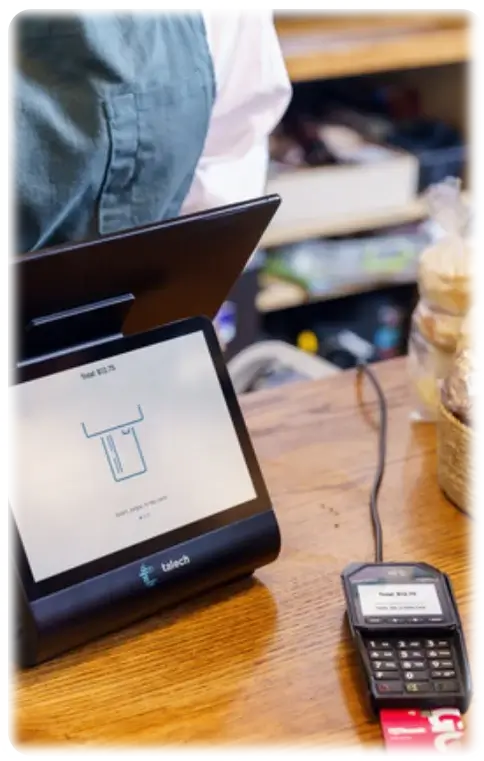

How does a retail merchant account function? Simply put, when a customer pays with a credit card swipe or mobile wallet, the merchant's point-of-sale (POS) system talks to the merchant account provider in the USA. The transaction is authorized, and the money is transferred from the customer's bank to your merchant bank account—usually within one day.

The Main Advantages Are:

- Secure retail merchant account transactions in the USA to safeguard both your business and your customers.

- Acceptance of various payment methods (credit card, debit, mobile payments).

- Increased sales and better cash flow.

- Customer loyalty and trust—providing easy payment choices.

- Compatibility with POS and eCommerce platforms.

- Lower risk of fraud through compliant merchant services accounts.

Knowing and selecting a retail merchant account for business owners in the USA involves assessing these advantages to suit your store's requirements.

What Do You Need To Consider When Selecting A Retail Merchant Account In The USA?

What is a retail merchant? It's a company that sells goods or services and must accept payments for them. When choosing a retail merchant account in the United States, look at these things:

- Merchant account fees: Check for transparent pricing—monthly fees, processing fees, chargeback fees.

- Processing speed: How quickly do the funds move? Retail merchant account processing services in the United States differ.

- Security features: Does the provider provide secure retail merchant account transactions in the USA with PCI compliance?

- Customer support: Is the provider reputed for prompt service? A good retail merchant account for the US should provide 24/7 support.

- Compatibility: Does the provider seamlessly integrate with your POS or eCommerce platform?

- Payment acceptance: Does it allow for credit cards, debit cards, mobile wallets, and contactless payments?

- Contract terms: Be wary of lengthy agreements or termination fees.

- Reputation: Check reviews and compare retail merchant account products from reputable providers.

How To Compare Different Retail Merchant Account Providers For Your Store?

How do I compare retail merchant account providers in the USA? Start by evaluating the Top 7 Best Retail Merchant Account Providers For Your Business. Here’s a simple comparison framework:

| Provider | Fees | Processing Speed | Security | Customer Support | Payment Options | Contract Term Reputation |

| Thrifty Payments | Low | Fast | PCI compliant | 24/7 support | Credit, mobile | Flexible Highly rated |

| Square | Transparent | Same-day | Encrypted | Excellent | All major cards | No long-term Trusted |

| Stripe | Competitive | Instant | Industry standard | Responsive | Online payments | No lock-in Popular |

Important tip: Always verify the retail merchant account processing services provided by each company in the USA, and compare the merchant retail services to determine the best retail merchant account for your store's size and requirements.

Why Are Some Retail Merchant Accounts More Supportive And Secure?

Support and security are essential because safe retail merchant account transactions in the USA prevent fraud, chargebacks, and data breaches. A secure US retail merchant account should have:

- PCI DSS compliance.

- Fraud prevention tools.

- Account reps.

- Rapid dispute resolution.

These features are what top providers specialize in, offering merchant retail services that secure your store and keep it operational.

What Are The Top Features To Look For In A Retail Merchant Account?

What is a retail account? It's not merely about taking payments—it's about the capabilities that make it convenient and secure to process:

- Multi-channel processing: In-store, online, mobile.

- Fast fund settlement.

- Fraud detection tools.

- Integrated POS and eCommerce support.

- Transparent fee structure.

- Support for multiple merchant card and credit card merchant accounts.

- Mobile payment acceptance.

- Customizable reporting and analytics.

Selecting a retail merchant account with these capabilities guarantees smooth transactions and customer satisfaction.

Where Can You Find The Best Retail Merchant Accounts For Small And Large Stores?

Where are they? Consider providers who offer the best retail merchant accounts in the USA of different sizes for stores:

- Small stores: The best retail merchant account for small stores in the USA tends to have lower fees, a simple setup, and no long-term contracts—such as Thrifty Payments or Square.

- Large stores or chains: Search for providers who provide high-volume processing, around-the-clock support, and advanced features—such as Stripe or PayPal.

In-store retail payment methods entail the acceptability of credit cards, contactless payments, and mobile wallets; hence, ensure your merchant account supports all your merchant outlets.

How To Save Money And Maximize Benefits With The Right Retail Merchant Account?

How to save money? Opt for Thrifty Payments first and compare merchant account banks with low fees and rebates on high-volume processing.

Maximize benefits by:

- Negotiating fee structures.

- Utilizing combined POS systems.

- Keeping merchant account and retail merchant account transactions in the USA secure.

- Avoiding unnecessary add-ons.

- Having your merchant services account under review for a good bargain.

What Are Typical Mistakes To Evade When Selecting A Retail Merchant Account?

Typical mistakes are:

- Choosing a provider without reading the merchant account reviews.

- Forgetting processing fees.

- Failure to look for security features.

- Missing contract term or cancellation fees.

- Failing to check for compatibility with your existing POS or eCommerce infrastructure.

- Engaging a provider that does not have complete merchant retail services.

Choosing a retail merchant account for USA business owners involves careful research to avoid the above mistakes.

How To Integrate Your Retail Merchant Account With Your Store's Pos And Ecommerce System?

How? Most merchant account providers offer plug-and-play solutions. While setting up a merchant account, ensure:

- The merchant account is compatible with your POS system.

- Online payments via APIs are supported.

- Seamless integration with your site or mobile app.

- Sufficient security features like tokenization.

Frequently Asked Questions

Q1: What is a merchant account?

A1: A merchant account is a bank account that enables retail merchants to process credit card payments, both online and in-store. It's the foundation of merchant payment processing, providing retail transactions with safety nationwide in the USA.

Q2: How does a retail merchant account function?

A2: If the customer is paying with a debit or credit card, your merchant account processes the transaction, moving funds from the customer's bank into your business's merchant account. This is a USA merchant services account, card processor account, and secure retail merchant account transaction.

Q3: What does a merchant account differ from a merchant payment?

A3: A merchant account is your bank account with funds from transactions, and merchant payment is the act or process of receiving a payment—e.g., in-store retail payment definition or online merchant payments.

Q4: How do you install a merchant account?

A4: You obtain a merchant account by choosing a merchant account provider, submitting necessary documents, and negotiating processing facilities. Certain USA providers, e.g., Thrifty Payments, ease the process of setting up retail merchants.

Q5: What is a merchant card processor account?

A5: It's a specific merchant account that supports credit card processing, including authorizations and settlements, which are critical to retail merchant account processing services in the USA.

Q6: How does having a merchant account benefit my business?

A6: It lets you accept credit card payments safely, expand customer options, drive sales, and drive your store's growth with secure retail merchant account solutions.

Q7: Why are secure retail merchant account transactions in the USA important?

A7: They protect your business and customers from fraud, ensure PCI compliance, and foster trust—keys to long-term success.

In-store payment acceptance is made easy when your merchant account is integrated successfully, boosting sales and customer satisfaction.

Conclusion: Making The Right Choice For Your Store

Choosing the top retail merchant account in the USA is not just about getting the lowest rates. It's about safeguarding your transactions, growing your business, and providing a seamless experience for your customers. From understanding what a retail merchant is to comparing USA retail merchant account providers, every step matters.

Remember, a reliable retail merchant account for the US is the backbone of your retail success. Whether you’re a small business owner or running multiple storefronts, take your time to evaluate features, security, and support. With the correct retail merchant account, you’ll open the door to more sales, happier customers, and a thriving business.

If you’re ready to apply for a merchant account, explore options like Thrifty Payments, or want to compare the Top 7 Best Retail Merchant Account Providers for Your Business, start today. Your store’s growth depends on it!