Subscription & Recurring Billing: Smarter Payment Management for Growing Businesses

Imagine a world where your business can predict cash flow with precision, customers are billed automatically without hassle, and you’re free from the constant back-and-forth of manual transactions. This is the power of subscription and recurring billing—a game-changer for businesses looking to streamline operations, boost customer loyalty, and create consistent revenue streams.

As more customers lean towards subscription-based services for convenience and flexibility, businesses across industries are jumping on board. Whether you're running a retail shop, offering digital services, or managing an online platform, subscription billing is becoming essential. But like any powerful tool, it requires the right strategy and technology to work effectively.

Without the proper systems in place, managing recurring billing can lead to frustrations—missed payments, failed transactions, and costly errors. That’s where subscription billing services and subscription payment management come in. These solutions can automate your recurring payments, reduce the manual effort involved, and enhance security, all while improving the customer experience.

In this blog, let’s dive into how subscription billing management and recurring billing services can revolutionize your business by making payment processes simpler, smoother, and more efficient.

What is Subscription Billing & Recurring Payment Management?

Subscription Billing Explained

Subscription billing is the process by which businesses automatically charge customers on a regular basis for access to goods, services, or content. Unlike one-time purchases, subscriptions create predictable, recurring revenue, which helps businesses better forecast income and cash flow. This model works particularly well in industries like SaaS (Software as a Service), e-commerce, hospitality, healthcare, and even local businesses like gyms or subscription box services.

What is Recurring Payment Management?

Recurring payment management is the technology and strategy behind the automatic billing process. It ensures that payments are processed smoothly at regular intervals — without requiring manual intervention from business owners or customers. Recurring billing management includes features such as payment reminders, handling declines or failed transactions, updating billing information, and even offering flexible billing cycles (monthly, quarterly, annually).

Together, subscription billing and recurring payment management make it easier to offer subscription-based services to customers while reducing the risk of errors, payment delays, and manual work.

Why Businesses Are Adopting Subscription & Recurring Billing Services

As businesses continue to evolve and seek new revenue models, subscription billing services have emerged as an ideal solution. Here’s why more businesses are turning to subscription billing and recurring billing management:

1. Predictable and Reliable Revenue

The biggest advantage of subscription billing is the predictability it offers. Unlike traditional one-time payments, subscriptions provide a consistent, recurring revenue stream. This makes it easier for businesses to plan, budget, and invest in growth. Predictable revenue also helps smooth out cash flow, making it more stable even during off-peak periods.

2. Stronger Customer Retention & Loyalty

Subscription models create long-term relationships with customers, rather than one-off transactions. By offering recurring billing and subscription payment management, businesses can encourage customers to stick around longer. For instance, instead of relying on customers to make a new purchase every time, you keep them engaged with ongoing value, which increases lifetime customer value (LTV). Loyal customers are more likely to share their experiences and recommend your services, driving organic growth.

3. Less Administrative Work

With automated subscription and recurring billing systems, businesses can reduce the amount of time spent managing billing and payment reminders. Subscription billing services handle everything from sending invoices to collecting payments on time, which means your team can focus on customer service, marketing, and other high-priority tasks. Automation eliminates human error and ensures accuracy with every transaction.

4. Flexibility to Offer Custom Payment Options

A recurring billing system doesn’t just manage payments; it allows you to offer your customers various flexible billing options. For example, businesses can offer monthly, quarterly, or annual payment plans. They can also provide tiered pricing models, so customers can choose a plan that fits their needs. This flexibility makes subscriptions more attractive to potential customers.

5. Data-Driven Insights & Reporting

Subscription billing systems often come with built-in reporting features that offer detailed insights into customer behavior and payment performance. Businesses can track which subscription billing plans are most popular, identify potential churn risks, and use the data to improve marketing strategies or service offerings. Real-time reporting helps businesses make data-driven decisions, optimize pricing, and target the right customers.

Common Challenges in Subscription Billing

While subscription billing is incredibly beneficial, it does come with some challenges. Many businesses face the following issues if they don’t have the right tools for recurring payment services and subscription billing management:

1. Payment Failures and Declines

Card declines or payment failures are common in subscription billing, especially when customers’ payment information is outdated or invalid. Without an automated system to retry payments or notify customers of the issue, businesses may miss out on payments and lose revenue.

2. Complex Pricing Models

Subscription services often have multiple pricing tiers or packages, which can complicate billing. For example, customers may switch plans, add or remove features, or apply discounts, making it difficult for businesses to keep track of all changes manually. A robust recurring billing management solution can manage these complex scenarios without error.

3. Handling Upgrades, Downgrades, and Cancellations

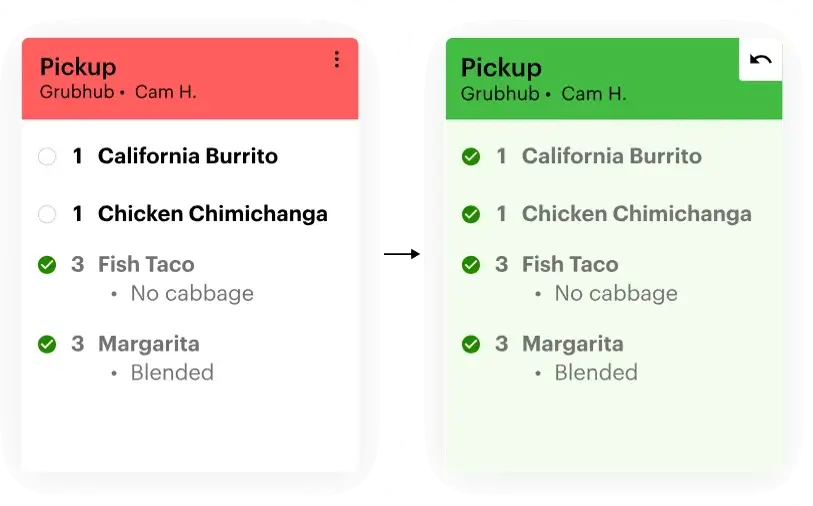

As customers move through different stages of their subscription (whether upgrading, downgrading, or cancelling), businesses need to ensure the billing system handles these changes seamlessly. If not managed properly, this can lead to confusion or billing errors, potentially frustrating customers.

4. Customer Communication

Subscription services require ongoing communication with customers, particularly around renewals, cancellations, and payment updates. Without automated reminders and notifications, customers may forget about payments or feel uninformed about changes to their subscription.

Key Features to Look for in Subscription Billing Solutions

When evaluating subscription billing management tools, businesses should look for the following features:

1. Automated Recurring Payment Services

Recurring payment services should automate the entire process — from payment collection to handling declines and retries — to reduce manual intervention.

2. Flexible Billing Cycles and Pricing Models

Choose a system that allows flexibility in payment plans (monthly, yearly, or custom intervals) and the ability to modify pricing based on upgrades or special promotions.

3. Robust Security Features & PCI Compliance

Ensure the billing solution complies with PCI DSS standards, encrypting customer data and safeguarding payment information. Security is critical, as data breaches can damage your reputation and lead to legal issues.

4. Self-Service Portals for Customers

Allow customers to manage their subscriptions, update payment details, and view their billing history through a user-friendly self-service portal. This reduces customer service workload and improves customer satisfaction.

5. Real-Time Reporting and Analytics

A good subscription payment management solution should offer detailed insights into payment activity, including revenue reports, customer churn rates, and failed payment statistics. These insights can help you make informed business decisions.

How Thrifty Payments Can Help Oregon Businesses with Subscription Billing

At Thrifty Payments, we understand the importance of reliable and secure subscription and recurring billing for businesses in Oregon. We offer subscription billing services tailored to your specific needs, providing seamless integration, scalable systems, and automated recurring billing management. Our solutions help businesses simplify payments, improve customer retention, and drive growth.

Here’s how we can support your business:

- Custom subscription billing solutions that integrate with your existing systems

- Transparent pricing with no hidden fees, so you can manage your costs effectively

- Hands-on, local support whenever you need it

- Industry-leading security to protect your customers’ payment data

- Real-time reporting and customer insights to help you optimize your business operations

Final Thoughts: Simplify Subscription Billing and Focus on Growth

Subscription billing offers an ideal way to build sustainable, predictable revenue, but it requires the right tools and strategy to ensure smooth operations. By choosing a reliable recurring billing management service, you can enhance your customers’ experience, reduce billing errors, and focus on growing your Oregon-based business.

Ready to streamline your subscription payment management? Thrifty Payments is here to help with flexible, secure, and cost-effective solutions tailored to your business.