The Best Mobile Credit Card Terminals For On-the-go Payments

There's a buzz in the air among small and mobile business owners throughout the USA — the need for top mobile credit card terminals is taking off in 2025. If you're selling artisanal jewelry at a local market, operating a food cart, or a pop-up store, having secure, trusted, and low-cost mobile payment processing is no longer a choice; it's a requirement. So, what are the best-rated mobile card terminals for processing on-the-go payments in 2025? How do you select the ideal mobile payment terminal for your business's specific needs? And which portable POS terminals offer speed, security, and affordability? This detailed guide will provide all the answers and help you grow your business with the best mobile credit card readers available today.

Best-rated Mobile Credit Card Terminals For Effortless On-the-go Payments In 2025

In the USA, the mobile credit card terminal market is flooded with choices, but not all are designed equally. The best mobile card terminals of 2025 are distinguished by how easy they are to use, the level of security they provide, compatibility with multiple devices, and price tags.

Some of the best entries include Square Reader, ** Clover Go**, SumUp, and PayPal Zettle. These wireless credit card terminals are world-famous for their lightweight portability, quick transaction speed, and contactless payments.

For example, the Square card reader has become a brand synonymous with small businesses in the USA because it is easy to integrate with smartphones and tablets, making any device a complete portable POS terminal.

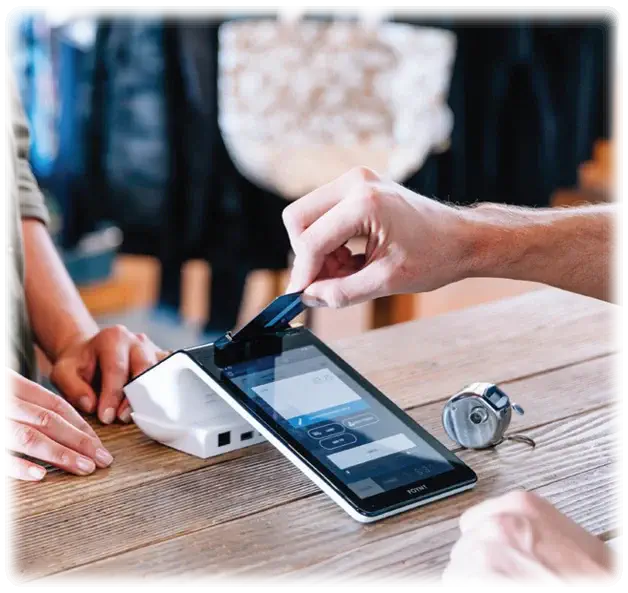

The top mobile credit card processing solutions also integrate with contactless payment devices in the USA, including Apple Pay, Google Pay, and Samsung Pay, which are becoming more popular among consumers. The contactless payment devices the USA provides enable quicker, more secure payments, minimizing waiting time and increasing customer satisfaction.

Ultimate Guide To The Best Mobile Card Terminals For Small Business Owners On The Move

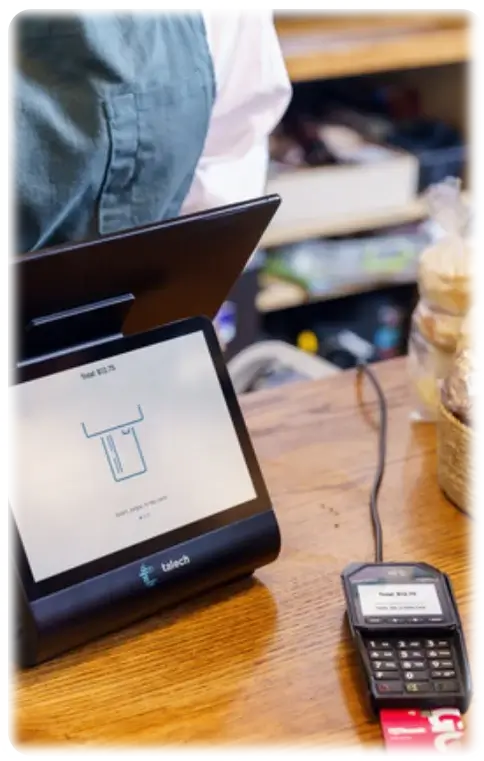

What does a mobile payment terminal really need to be effective and secure? It can accept payments promptly, securely store sensitive customer information, and seamlessly integrate with your current business system.

The top mobile card readers for small business owners are those that provide secure mobile payment solutions in the USA. Some features to look for include EMV chip support, NFC contactless payment acceptance, encrypted transactions, and PCI DSS compliance.

For small business card readers, the Square mobile card reader and SumUp are prominent because they are affordable mobile credit card machines that don't compromise security. They also have easy-to-use interfaces, so accepting credit card payments on my phone is straightforward.

Why go for portable POS terminals? Because they let you accept payments everywhere—from farmers' markets to in-house at a client's office, to outdoor festivals. Light, battery-operated, and simple to configure, these portable POS terminals let your business never miss a sale.

Find The Most Trustworthy Mobile Credit Card Terminals For Mobile Business Owners In The USA

Reliability matters when choosing mobile credit card terminals in the USA. You desire a machine that operates flawlessly, offers key features, and provides affordable mobile credit card terminals without compromising security.

What is the best credit card reader for mobile phones? For most, it's the Square reader, particularly because it's free when you join and buy a compatible plan. Its square mobile card payment device has a reputation for durability and simplicity, making it ideal for mobile entrepreneurs who require the best portable credit card reader solutions.

Other dependable alternatives include Stripe Terminal, which provides secure mobile payment solutions in the USA with strong API integrations, and PayPal Zettle, which is known for its ease of integration with PayPal accounts.

How To Pick The Ideal Mobile Payment Terminal For Your Business Requirements

The right mobile credit card terminal to pick relies on several things:

Compatibility: Is it compatible with your phone? Search for a credit card reader for iPhone in the USA or for Android mobile card terminal alternatives.

Security: Is it EMV chip and contactless payment-friendly? Security features are not negotiable.

- Cost: Are the cost-effective mobile credit card terminals within your budget? Keep in mind that some providers offer waived hardware with some plans.

- Transaction fees: Compare top mobile credit card reader rates to save you money.

- Ease of use: Is it easy to use? Will your employees have to spend a lot of time training?

- Connectivity: Does it use wireless credit card machines or need Wi-Fi?

- Customer support: Good customer service can be a lifesaver during peak periods.

Where Can You Buy A Mobile Pos System Online?

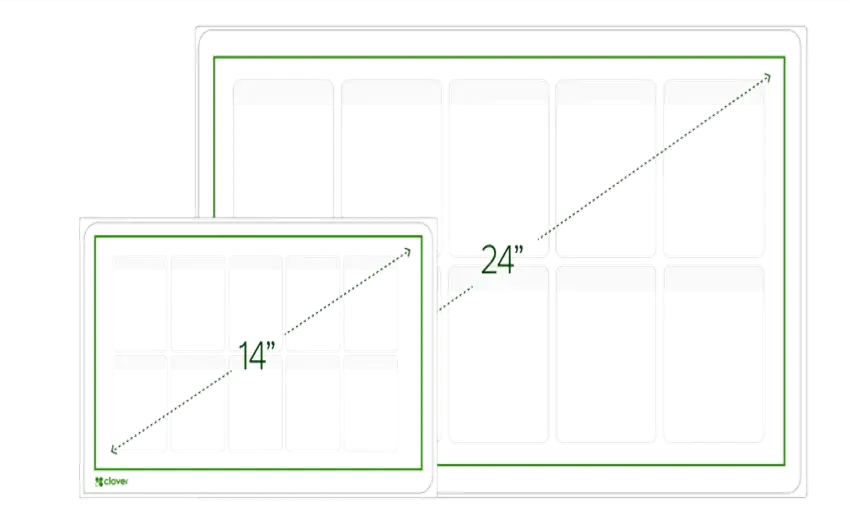

Reliable sources include the official websites of providers such as Square, SumUp, and Clover, as well as Amazon and specialized POS distributors.

Expert Reviews: The Best Portable Card Terminals for Rapid, Secure Transactions Everywhere

What are the advantages and disadvantages of well-known mobile credit card terminals? Here's a brief overview:

| Device | Pros |

| ||

| Square Reader | Easy setup, contactless, affordable |

| ||

| Clover Go | Robust security, suitable for high-volume sales | Slightly higher transaction fees | ||

| SumUp | Budget-friendly, no monthly fee | Fewer integrations | ||

| PayPal Zettle | Seamless PayPal integration | Limited hardware options |

Why Do They Prefer Them?

They offer the best mobile card reader functionality with secure mobile payment solutions in the USA for fast, secure transactions on the move.

Boost Your Business With These Top Mobile Card Terminals For On-the-go Payments

Envision a bustling weekend market where shoppers can pay quickly and with minimal contact. The ideal mobile credit card reader in this case is a wireless reader, such as Square's or SumUp's portable point-of-sale terminals. These terminals support quick, secure, and reliable mobile credit card processing.

What are the advantages? More sales, smiling customers, and less cash to handle. And with contactless payment machines in the USA, your business is more attractive to tech-savvy customers.

Top Mobile Credit Card Terminals For Small Business In The USA

For small businesses, the ideal mobile credit card terminal means weighing cost, security, and ease of use. Top choices are:

- Square mobile card reader: Famous for free credit card reader promotions and simple integration.

- Stripe Terminal: Provides secure mobile payment solutions in the USA with much customization.

- SumUp: Great if you want cheap mobile credit card terminals with straightforward pricing.

- PayPal Zettle: Best if you already have PayPal for online business.

Where To Buy Mobile Credit Card Terminals?

You can purchase a mobile POS system directly from the provider's website or from approved resellers like Thrifty Payments.

What Makes A Mobile Payment Terminal Really Effective And Secure?

The answer: It should support EMV chip, NFC contactless payments, and encrypt transactions end-to-end. A credit card scanner that meets PCI DSS requirements and offers strong fraud protection provides secure mobile payment solutions in the USA.

Why Is Security Important?

Because customer confidence depends on how well your wireless credit card machine keeps their information secure. Most of the best wireless credit card terminals available in 2025 have integrated security features, so taking credit card payments on my phone is more secure than ever.

User-preferred Mobile Card Terminals That Revolutionize Your Payment Process

According to user reviews, some of the best cell phone credit card readers are:

- Square Reader — a favorite for free Square Reader promotions and ease of use.

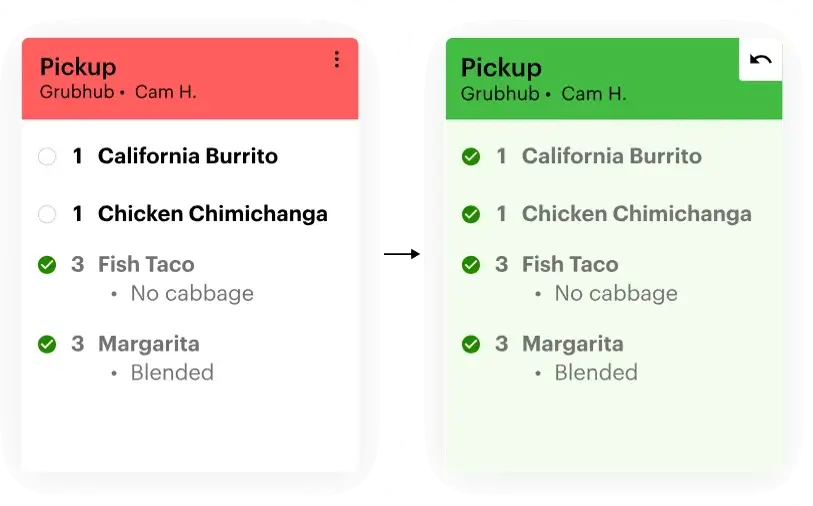

- Clover Go — a favorite for business credit card reader features.

- SumUp — a favorite portable credit card reader with budget-friendly small business owners.

- PayPal Zettle — a favorite for easy mobile credit card processing using existing PayPal accounts.

These machines are popular because they simplify accepting credit card payments on my phone and offer secure mobile payment solutions in the USA that customers can rely on.

Future-proof Your Business: The Best Mobile Credit Card Terminals For 2025 And Beyond

In the future, contactless payment machines in the USA will still be the norm. The best mobile credit card reader in 2025 will have support for future technologies such as NFC, biometric verification, and tokenization.

What's next for mobile credit card processing? Speed, security, and flexibility. Companies that hop on early by investing in economical mobile credit card terminals will see a boost in sales and customer retention.

Where do you get ahead? With a mobile POS system, you can make online purchases from reliable providers offering the latest, secure mobile payment solutions like Thrifty Payments in the USA.

Frequently Asked Questions

Q: How can I accept credit card payments using my phone?

A: Utilize a mobile credit card reader such as the Square card reader or Clover Go. Plug the device into your phone, install the compatible app, and begin accepting payments.

Q: Which is the best mobile credit card reader for a small business?

A: The Square Reader is still a top pick because it is cheap, easy to use, and has secure mobile payment solutions in the USA.

Q: Are contactless payment devices in the USA secure?

A: Yes. They use NFC technology and encryption, making contactless payment devices in the USA a very secure solution.

Q: How can I buy a mobile POS system online?

A: You can purchase a mobile POS system online from provider websites such as square.com, or from reputable resellers on Amazon and POS-specialized retailers.

Q: What are the best features of the best mobile credit card reader?

A: Check for EMV chip support, NFC/contactless payment support, encryption, device compatibility (iPhone or Android), and price.

Conclusion

Selecting the most appropriate mobile credit card terminal in 2025 is essential for small businesses and mobile entrepreneurs to remain competitive. From wireless credit card terminals to mobile POS terminals, there are many choices. Still, the most important thing is finding a device that provides secure mobile payment solutions in the USA, is easy to use, and costs less.

By using contactless payment terminals in the USA and purchasing a mobile POS system online, you can enrich your customer experience, drive sales, and future-proof your enterprise. Recall, the correct mobile credit card reader is not just a tool — it's a cornerstone of your success story in today's fast-moving, cashless economy.